In recent years, Bitcoin has cemented its status as a revolutionary digital asset, reshaping the landscape of investment. As Bitcoin continues to gain mainstream traction, the ways investors can gain exposure to this cryptocurrency have diversified. Two primary methods for investors to consider are investing in Bitcoin through spot exchange-traded funds (ETFs) and purchasing Bitcoin directly.

1. Introduction to Bitcoin

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. Designed as a decentralized digital currency, Bitcoin operates on a peer-to-peer network that allows users to send and receive payments without the need for intermediaries like banks. Bitcoin's underlying technology, blockchain, ensures transparency and security through a distributed ledger.

As a store of value and a means of transferring wealth, Bitcoin has attracted attention from retail investors, institutional players, and entire nations. Its scarce supply, capped at 21 million coins, along with increasing demand, has driven its price to new heights, making it a subject of significant interest for investment.

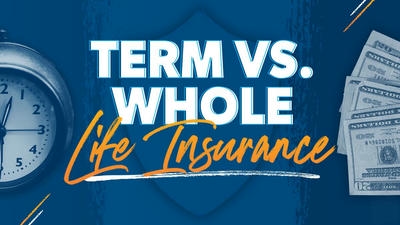

2. Understanding Bitcoin ETFs

2.1 What is a Spot Bitcoin ETF?

A spot Bitcoin ETF is a financial product that tracks the price of Bitcoin and is traded on traditional stock exchanges, allowing investors to gain exposure to Bitcoin without needing to own the underlying asset. The ETF holds actual Bitcoin in reserve, and its value is directly tied to the market price of Bitcoin. This structure provides investors with a way to participate in Bitcoin price movements through a regulated investment vehicle.

2.2 How Does a Spot Bitcoin ETF Work?

A spot Bitcoin ETF operates by holding Bitcoin directly within the fund. When an investor buys shares of the ETF, they are essentially buying a fractional ownership of the Bitcoin held in the fund. The price of the ETF shares fluctuates based on the market price of Bitcoin, enabling investors to trade these shares throughout market hours just like stocks.

The ETF is managed by a fund manager responsible for ensuring that the fund holds sufficient Bitcoin to back the shares issued. This creates a mechanism for arbitrage, whereby the price of the ETF shares aligns closely with the price of Bitcoin. If the ETF shares are trading at a premium to the Bitcoin price, investors can purchase Bitcoin on the open market and create new ETF shares to profit off the difference.

3. Direct Ownership of Bitcoin

3.1 What Does Direct Ownership Mean?

Direct ownership of Bitcoin means purchasing and holding Bitcoin in a cryptocurrency wallet without relying on any intermediary platform or financial product. This ownership gives investors full control over their assets, allowing them to send, receive, and manage their Bitcoin as they see fit.

3.2 How to Buy and Store Bitcoin

To buy Bitcoin directly, investors typically use cryptocurrency exchanges where they can convert fiat currency into Bitcoin. The process generally involves the following steps:

Choose a Cryptocurrency Exchange: Select a reputable exchange that supports Bitcoin trading, such as Coinbase, Binance, or Kraken.

Create an Account: Sign up for an account on the chosen exchange and complete any necessary identity verification.

Fund Your Account: Deposit funds into your exchange account using a bank transfer or credit card.

Purchase Bitcoin: Use the funds in your account to buy Bitcoin at the current market price.

Store Your Bitcoin: After purchasing, transfer your Bitcoin to a secure wallet. Options include hardware wallets, software wallets, and mobile wallets, each offering different levels of security.

4. Key Differences Between Spot Bitcoin ETFs and Direct Ownership

Investors must consider several key differences when choosing between spot Bitcoin ETFs and direct ownership of Bitcoin. These differences can significantly impact investment strategies and overall returns.

4.1 Regulatory Environment

Spot Bitcoin ETFs operate within a regulated framework, providing a level of oversight that can enhance investor confidence. The approval and regulation of Bitcoin ETFs involve scrutiny from financial institutions and governmental bodies, such as the Securities and Exchange Commission (SEC) in the United States.

In contrast, direct ownership of Bitcoin takes place in a largely unregulated environment. While this allows for greater freedom and flexibility, it also exposes investors to higher risks associated with security breaches, scams, and regulatory uncertainties.

4.2 Custody and Security

With spot Bitcoin ETFs, the fund manager assumes responsibility for the custody and security of the Bitcoin held in the ETF. Investors do not have to worry about securing their private keys or protecting against hacking incidents, as these functions are handled by the ETF management team.

When owning Bitcoin directly, investors are responsible for safeguarding their assets. This includes using secure wallets, setting up two-factor authentication, and following best practices to prevent theft or loss of funds.

4.3 Fees and Costs

Investing in spot Bitcoin ETFs often involves management fees and expense ratios. These fees can vary depending on the ETF provider and may reduce overall returns over time. However, the structured and regulated nature of ETFs can provide investment ease and convenience.

Direct ownership typically incurs lower ongoing costs, but investors may face transaction fees when buying or selling Bitcoin on exchanges. Additionally, there could be costs associated with wallet security measures, such as hardware wallets.

4.4 Tax Implications

Tax implications differ significantly between spot Bitcoin ETFs and direct ownership. In many jurisdictions, profits from selling Bitcoin directly are subject to capital gains tax, and investors must track their cost basis for accurate reporting.

For spot Bitcoin ETFs, tax treatment can vary based on how the ETF is structured. While investors might benefit from simpler reporting, they should consult tax professionals to understand the implications of ETF investments fully.

5. Pros and Cons of Spot Bitcoin ETFs

5.1 Advantages of Spot Bitcoin ETFs

- Regulatory Oversight: Spot Bitcoin ETFs are regulated financial products, which can increase confidence among investors and traditional institutional participants.

- Ease of Access: ETFs can be easily purchased and sold like stocks, making them accessible to a broader range of investors, including those who may not want to deal with the complexities of direct Bitcoin ownership.

- Simplified Tax Reporting: Spot Bitcoin ETFs may provide a streamlined approach to tax reporting compared to tracking individual Bitcoin transactions.

- Professional Management: Investing in an ETF means having the fund manager handle custody and security, reducing investor responsibility for asset protection.

5.2 Disadvantages of Spot Bitcoin ETFs

- Management Fees: Ongoing management fees associated with ETFs can erode long-term returns.

- Limited Control: Investors in Bitcoin ETFs lack control over their assets as they do not own the Bitcoin directly.

- Market Premiums and Discounts: ETFs can trade at premiums or discounts to their net asset values, which can affect the price investors pay relative to the underlying Bitcoin market.

6. Pros and Cons of Direct Ownership

6.1 Advantages of Direct Ownership

- Full Ownership and Control: Direct ownership provides complete control over Bitcoin assets, allowing investors to manage their holdings without intermediaries.

- Potential for Lower Costs: Direct ownership may incur fewer ongoing fees, leading to higher long-term returns compared to ETFs.

- Flexibility: Investors can utilize their Bitcoin in various ways, including trading, transferring, or using it in decentralized finance (DeFi) applications.

6.2 Disadvantages of Direct Ownership

- Security Responsibility: Owners must take responsibility for securing their Bitcoin, which can be daunting and risky if proper measures are not followed.

- Complex Tax Reporting: Tracking individual transactions and calculating capital gains can complicate tax reporting for direct Bitcoin ownership.

- Limited Accessibility for Traditional Investors: Some investors may find it challenging to navigate the cryptocurrency ecosystem and may prefer the familiarity of traditional investment vehicles like ETFs.

7. Factors to Consider Before Investing

Before deciding between spot Bitcoin ETFs and direct ownership, consider the following factors:

- Investment Goals: Determine your long-term investment objectives. Are you looking for a simple way to gain exposure to Bitcoin, or do you want complete control and flexibility over your assets?

- Risk Tolerance: Assess your risk tolerance when it comes to security, regulatory uncertainty, and market volatility. Direct ownership involves more risk, while ETFs provide regulatory safeguards.

- Investment Horizon: Consider your investment timeline. If you're a long-term investor, direct ownership might offer better returns in the long run, while ETFs could suit those looking for short-term trading opportunities.

- Knowledge and Experience: Reflect on your understanding of cryptocurrencies and the crypto market. Beginners might find ETFs more approachable, while experienced investors may prefer the autonomy of direct ownership.

8. Future Trends in Bitcoin Investment

As the cryptocurrency landscape continues to evolve, several trends are expected to shape the future of Bitcoin investment:

- Increased Institutional Adoption: As traditional financial institutions increasingly embrace Bitcoin, we can expect more products like spot ETFs, attracting a broader range of investors.

- Regulatory Developments: Ongoing regulatory conversations will influence the landscape for both spot Bitcoin ETFs and direct ownership. Clarity around regulations could lead to more secure investment environments.

- Innovative Financial Products: The evolution of technological and financial instruments could bring forth new investment avenues for Bitcoin, expanding options for investors.

- Integration of Bitcoin into Traditional Portfolios: As Bitcoin gains recognition as a legitimate asset class, investors may incorporate it into traditional portfolios alongside stocks and bonds.

9. Conclusion

Investing in Bitcoin has become increasingly accessible through various methodologies, with spot Bitcoin ETFs and direct ownership being the two primary options. Both approaches offer unique strengths and weaknesses, catering to different investor preferences and risk appetites.

Spot Bitcoin ETFs provide a regulated, user-friendly pathway for gaining exposure to Bitcoin without the complexities of managing the asset directly. However, they come with management fees and limitations in control. Conversely, direct ownership offers investors full control and fewer ongoing costs, but it requires a greater level of security diligence and market knowledge.

Ultimately, the choice between spot Bitcoin ETFs and direct ownership will depend on individual investment goals, risk tolerance levels, and personal preferences. As the cryptocurrency landscape continues to evolve, investors must stay informed and make educated decisions to navigate this dynamic market successfully.